Open Banking / Payments

Simple yet Innovative

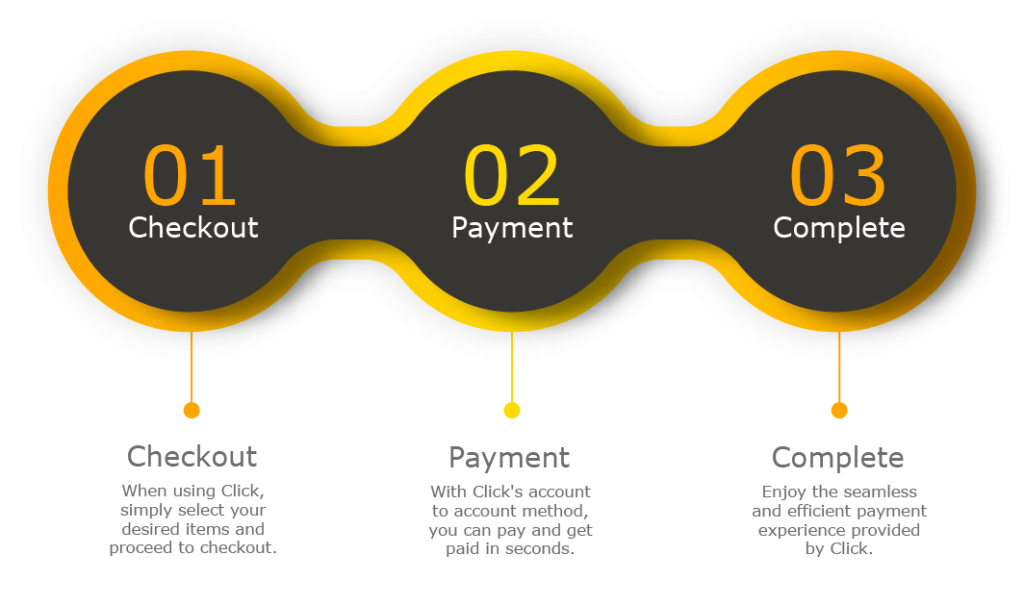

Checkout flows should be incredibly fast and convenient. Empower your customers with a streamlined checkout with the fewest clicks, taps or swipes possible. Click lets you perform payments without prior knowledge of the user.

Operating at the same security level as banks, our service integrates Strong Customer Authentication (SCA), removing unnecessary hurdles for B2B and B2C accounts alike. With one simple integration, you can enable instant payments across the UK and Europe.

High-quality Code

Our simple payment initiation service connects you to hundreds of banks across the UK and Europe.

Agile Approach

We give businesses an entire payments ecosystem built around what they need and nothing they don’t.

Next Generation

Our inbuilt Secure Customer Authentication removes the need for additional KYC checks, streamlining the checkout experience.

Better Data

Our back-office extracts, prepares and delivers your payments data in an easy-to-use interface for all transactions.

A better way to pay and get paid

We help businesses offer their customers a faster, safer, seamless payment experience.

This is example text for the step 1:

OPEN BANKING USE CASES FOR PAYMENT PROVIDERS

Instantly top-up digital wallets

Instantly pull funds from customers’ bank accounts into digital wallets to make investing easier and more accessible.

Make merchant payments faster

Use Faster Payments and local rails to expedite settlement, avoid interchange fees, and reduce the risk and impact of fraud and data breaches.

Optimise customer journeys

Make check-out easier for merchants, prevent failed payments and drop-off, and save money on payment processing.